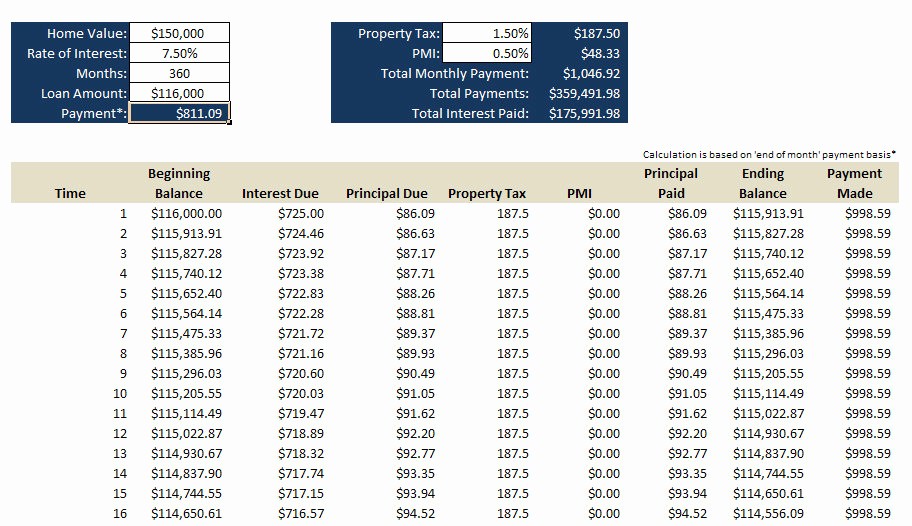

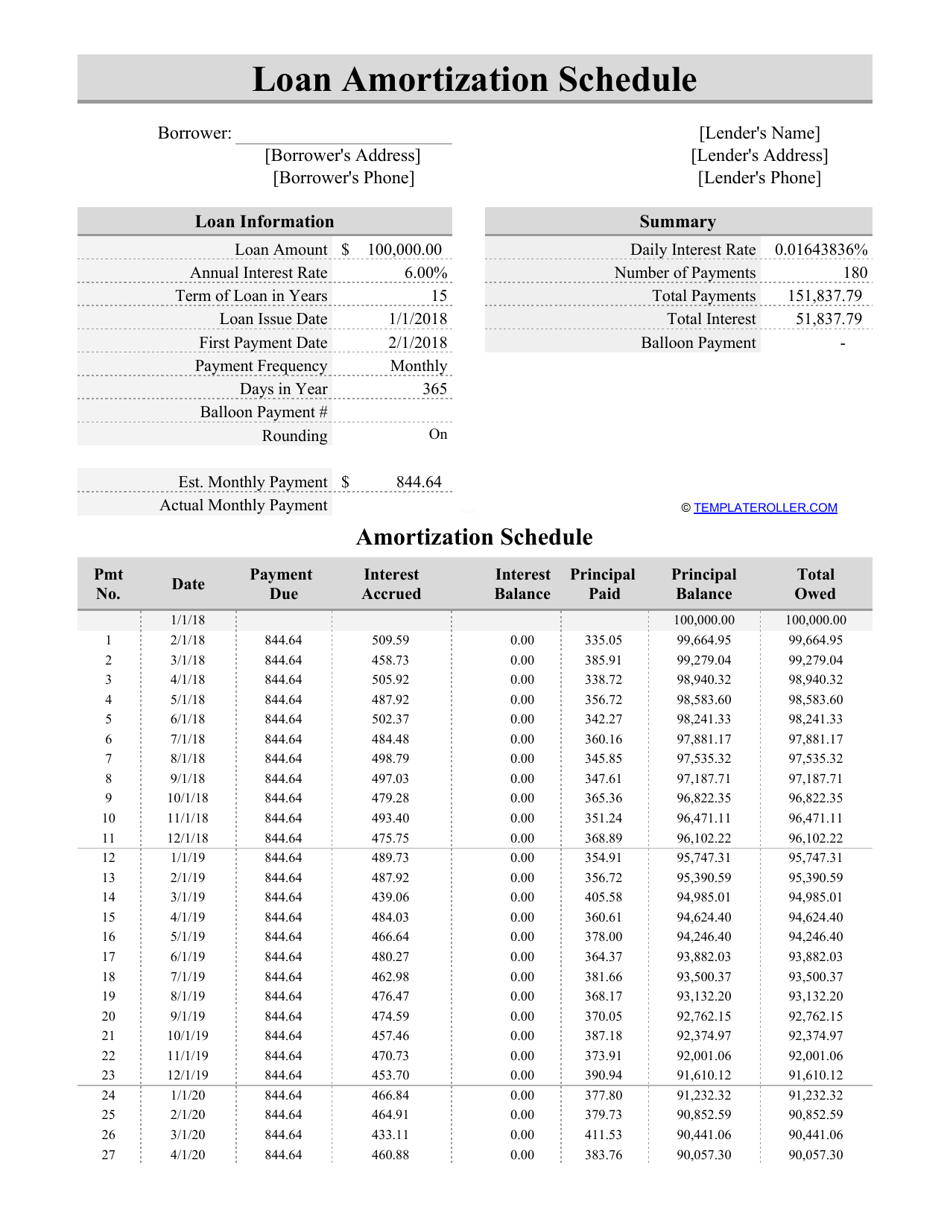

Step 1: Convert the annual interest rate to a monthly rate by dividing it by 12. Customer support is exceptional, the price is very reasonable and the calculator is sure to increase website visitors, repeat visitors and the time they spend on our site - which is incredibly valuable. Our amortization calculator will do the math for you, using the following amortization formula to calculate the monthly interest payment, principal payment and outstanding loan balance. Most typical car loans and mortgages have an amortization schedule with equal payment installments. Simply enter your loan amount, terms, interest. Payment Amount Principal Amount + Interest Amount. Amortization is the process of gradually reducing a debt through installment payments of principal and interest. The amortization table shows how each payment is applied to the principal balance and the interest owed.

The calculator's colors were customized to match those of our website's and it was a simple easy process from start to finish. This amortization schedule calculator allows you to create a payment table for a loan with equal loan payments for the life of a loan. It's a valuable tool that provides more than just a payment calculation.

“AmortizeCRE's amortization calculator is hands down the best I've seen. This drives borrowers/agents directly to my website for self-access 24/7.” – David De La Torre, Regional Manager, Global Funding Quickly see how much interest you could pay and your. This saves many hours out of my day where clients can self-estimate their payments and closing costs. Use this home loan calculator to generate an estimated amortization schedule for your current mortgage. “In addition to the amortization calculator, Ryan/AmortizeCRE developed custom closing cost website applications that are user/agent/borrower friendly. Thank you everyone at team AmortizeCRE.” – Colin Dubel, Commercial Mortgage Advisor, HarborWest Commercial Lending A loan amortization schedule is calculated using the loan amount, loan term, and interest rate. Our loan calculator is such an integral part of our website for clients and has driven new traffic to our website. Conforming fixed-rate estimated monthly payment and APR example: A 225,000 loan amount with a 30-year term at an interest rate of 3.875 with a down payment of 20 would result in an estimated. A quick and easy way to calculate the cost of a mortgage loan and monthly payments. Very simple process, and worked with us personally to customize what we wanted. Use this amortization calculator to help you determine how many months it could take to pay off your loan with or without making extra payments.

0 kommentar(er)

0 kommentar(er)